|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding 30 Year Fixed Mortgage Rates Today: A Comprehensive GuideIntroduction to 30 Year Fixed Mortgage RatesThe 30-year fixed mortgage rate is a popular choice for homebuyers due to its stability and predictability. This type of mortgage offers a consistent interest rate and monthly payments that never change over the life of the loan. Today, understanding these rates can significantly impact your home buying process. Key Features of 30 Year Fixed Mortgages

Factors Influencing Today's RatesSeveral factors influence the current 30-year fixed mortgage rates. Economic conditions, inflation, and the Federal Reserve's monetary policy play pivotal roles. Additionally, individual factors such as credit score and loan amount affect the rates available to borrowers. How to Secure the Best Rates

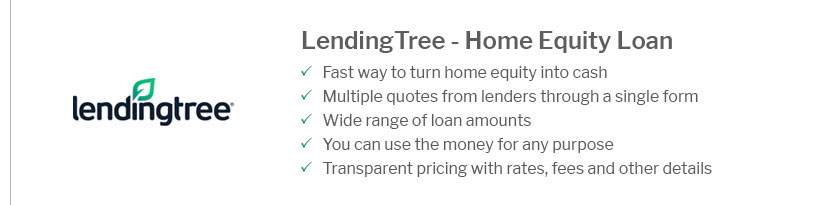

Alternatives to 30 Year Fixed MortgagesWhile the 30-year fixed mortgage is a staple, there are alternatives worth considering. For example, a fixed home equity loan could be an option if you're looking to leverage your property's equity for other financial goals. Shorter Term LoansOpting for a 15-year fixed mortgage can save money on interest, although it comes with higher monthly payments. Adjustable Rate MortgagesARMs may offer lower initial rates, which can be beneficial if you plan to move or refinance before the rate adjusts. Frequently Asked Questions

https://www.nerdwallet.com/mortgages/mortgage-rates

On Thursday, March 27, 2025, the average APR on a 30-year fixed-rate mortgage fell 6 basis points to 6.769%. The average ... https://www.bankofamerica.com/mortgage/mortgage-rates/

Today's competitive mortgage rates ; 30-year fixed - 6.625% - 6.908% - 0.771 - $1,281 ; 20-year fixed - 6.375% - 6.756% - 0.878 - $1,476 ; 15-year fixed - 5.750% - 6.188%. https://www.rocketmortgage.com/mortgage-rates/30-year-mortgage-rates

30-Year Mortgage Rates ; 30-year Fixed - 7.125% - 7.449% ; 30-year FHA - 6.375% - 7.261% ; 30-year VA - 6.375% - 6.8% ; 30-year jumbo fixed - 6.125% - 6.329%.

|

|---|